Trust Foundations Unveiled: Opening the Tricks to Genuine Connections

Secure Your Assets With Our Trust Fund Foundation: Offshore Trust Fund Services

Are you worried concerning the security of your properties? With our Depend on Structure's overseas count on services, you can relax easy knowing your properties are secured. As opposed to common belief, offshore trusts are not just for the affluent elite. Our services come to individuals like you that value the protection and flexibility that offshore trust funds supply. By utilizing our trust fund structure, you can protect your properties from possible risks and unpredictabilities. Don't let doubts hold you back from protecting your monetary future (trust foundations). Capitalize on our offshore count on services and obtain satisfaction understanding that your hard-earned assets remain in safe hands.

The Advantages of Offshore Depends On

Offshore trust funds supply various advantages that can help safeguard your properties and optimize your monetary planning. One of the essential advantages of overseas trust funds is the raised level of possession security they provide.

Another substantial advantage of overseas counts on is the possibility for tax optimization. Numerous overseas jurisdictions offer favorable tax obligation regimes, enabling you to reduce your tax obligations and maximize your riches. By developing an overseas count on, you can make use of tax obligation motivations, exceptions, and lower tax obligation prices. Additionally, offshore trusts give privacy and privacy, as they are exempt to the same coverage demands as onshore territories. This can aid secure your economic info and maintain it out of the public eye.

Moreover, offshore trusts offer adaptability and convenience in estate planning. trust foundations. With an overseas count on, you can define exactly how your properties are to be distributed upon your death, guaranteeing that your dreams are accomplished exactly. This can be specifically beneficial for people with complicated household frameworks, worldwide assets, or issues concerning probate and inheritance laws in their home territory

How Our Trust Foundation Works

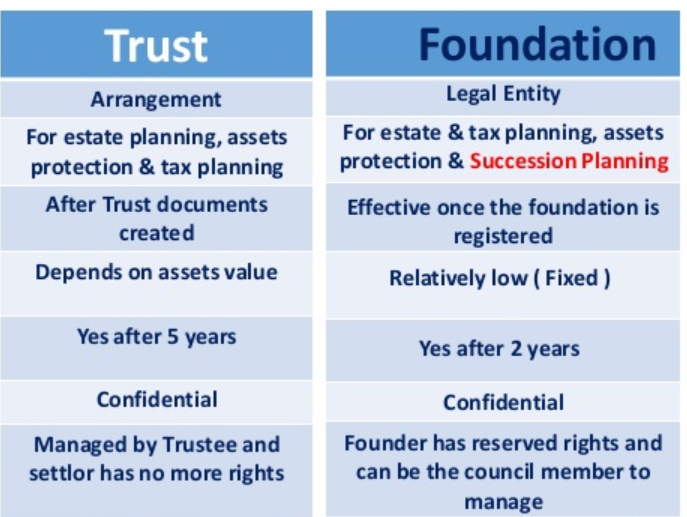

With our Depend On Foundation, you can properly handle and safeguard your properties with our offshore trust fund services. Our Trust fund Structure functions by establishing a lawful entity that holds and manages your assets on your behalf. This entity is separate from you as an individual, offering an included layer of defense for your possessions.

To start, you will certainly need to establish the Trust Foundation by designating a trustee, that will certainly manage the administration of your assets. The trustee can be a private or a professional trustee firm, depending on your choices and demands.

When the Depend on Structure is developed, you can move your assets into the depend on, allowing them to be held and managed by the trustee. This splitting up of possession offers various benefits, including possession security, tax obligation preparation, and estate preparation benefits.

The trustee will act based on the terms established out in the trust action, making sure that your assets are handled and dispersed according to your dreams. They will additionally look after any kind of needed management jobs, such as record-keeping, tax obligation coverage, and conformity with pertinent laws and regulations.

With our Trust Foundation, you can have comfort knowing that your assets are being efficiently managed and protected. Our offshore depend on services use a confidential and safe environment, allowing you to navigate here maintain control over your assets while lessening threats.

Secret Features of Our Offshore Trust Fund Solutions

Our offshore depend on solutions provide a variety of essential features that can aid you secure and expand your possessions. Furthermore, our offshore count on services supply asset defense. You have the ability to personalize the depend on framework according to your specific demands and needs, enabling you to preserve control over your visit here assets while still taking pleasure in the benefits of a trust fund.

Actions to Establish Your Trust

To develop your count on, you will certainly require to follow a series of steps that ensure the safety and performance of the process. You need to gather all the essential info and documents needed to set up the trust. This consists of identifying the assets you wish to secure, establishing the beneficiaries, and selecting a trustee who will certainly handle the trust fund in your place.

Following, you will certainly require to pick the jurisdiction where you intend to establish your trust - trust foundations. It is crucial to select a jurisdiction that uses solid possession defense regulations and makes certain the confidentiality of your trust fund. Our count on structure supplies solutions in numerous trustworthy territories, giving you the versatility to choose the one that ideal matches your requirements

Once you have selected the jurisdiction, you will need to engage with our professional group to prepare the depend on arrangement. This lawful file outlines the terms of the trust fund, consisting of the powers and responsibilities informative post of the trustee, distribution provisions, and any type of specific guidelines you might have.

After the trust fund arrangement is composed, it will certainly require to be executed and sworn. This step makes certain the credibility of the depend on and its conformity with legal requirements. Finally, you will transfer your assets right into the count on, effectively positioning them under the security of the trust fund structure.

Safeguarding Your Assets: Trustee Obligations

To correctly protect your properties, the trustee has crucial responsibilities that have to be satisfied. As the trustee of an overseas depend on, your major duty is to act in the most effective rate of interests of the trust fund beneficiaries. This indicates making choices that will safeguard and grow the trust fund possessions for their benefit.

Among your key duties is managing the trust fund possessions prudently. This entails spending the assets intelligently and expanding the profile to reduce threat. You must also maintain accurate documents of all economic deals and provide regular records to the beneficiaries, making sure transparency and liability.

Another crucial obligation is to shield the depend on properties from any potential dangers or cases. This consists of taking steps to guard against burglary, mismanagement, or scams. You need to also ensure compliance with all appropriate legislations and policies to prevent any kind of lawful concerns that might jeopardize the trust fund.

As a trustee, you are likewise responsible for making distributions to the beneficiaries according to the terms of the trust fund. It is important to work out audio judgment and think about the beneficiaries' requirements and conditions when making these circulations.

Verdict

By developing your count on and delegating it to our experienced trustees, you can have tranquility of mind understanding that your properties are safeguarded for the future. Begin safeguarding your assets today with our overseas trust fund solutions.

With our Depend on Structure's offshore count on services, you can relax easy knowing your assets are shielded.With our Trust Foundation, you can effectively handle and protect your assets via our offshore count on services. You have the capacity to customize the trust fund framework according to your certain needs and needs, permitting you to preserve control over your assets while still taking pleasure in the advantages of a count on. You will certainly move your possessions into the trust fund, successfully putting them under the defense of the count on framework.

As the trustee of an overseas count on, your major obligation is to act in the finest rate of interests of the depend on recipients.